5G Fund: How many locations will be eligible for this $9 billion program for rural 5G?

As all of us have focused on the BEAD program to bring fixed broadband to rural areas, the FCC has quietly moved another program forward: the proposed “5G Fund for Rural America”, a program that could be as large as $9 billion. As of March, Chairwoman Rosenworcel circulated to colleagues a draft order that would restart the 5G Fund. (INCOMPAS, out of concern for high USF funding, has proposed postponing the program by several years.)

This would be a reverse auction (similar to RDOF) where carriers would bid against each other in successive rounds, with the FCC trying to find the carrier willing to provide 5G at the lowest cost.

One of the biggest issues in the docket was clearly the definition of eligible areas. The FCC appears to want to define eligible areas as only those without any coverage, while other stakeholder pushed for eligible areas to be anything without 5G coverage.

Throughout this proceeding, some parties have taken issue with the definition of areas eligible for 5G Fund support. These parties maintain that the Commission incorrectly presumed that an area that has unsubsidized 4G LTE service will see the deployment of 5G service without the need for subsidies, and/or ask the Commission to define the areas eligible for 5G Fund support as those where BDC mobile coverage data show a lack of unsubsidized 5G broadband service.

The draft order circulating now would, according to the press release, “modify the definition of areas eligible” for the Fund. Perhaps this question is not settled.

How the eligible areas are decided has a dramatic difference on this program. The Chairwoman’s press release says “over 14 million homes and businesses lack mobile 5G coverage.” That’s the number of people that don’t have access to 5G in an in-vehicle environment. (In-vehicle coverage maps show less coverage than an “outdoor stationary” propagation model.) Using that definition, 11.7% of locations in the U.S. would be eligible.

But using the definition which the FCC appears poised to choose changes things dramatically. If areas are only eligible if they lack both 4G and 5G coverage in an in-vehicle environment, only 3.6 million locations are eligible, 3.2% of the total. Using the broadest possible coverage definition, no 4G or 5G in an outdoor stationary environment, leaves only 875,000 locations eligible, just 0.77% of the total locations in the U.S..

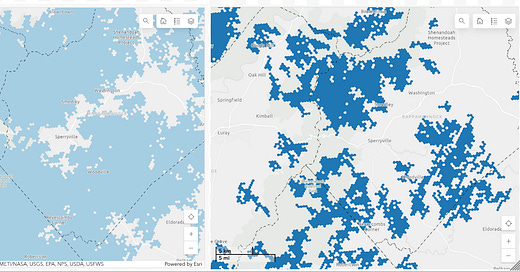

As a side-by-side, here’s how big the difference is between outdoor stationary and in-vehicle coverage. Here’s the area around Sperryville, Virginia. On the left is the area lacking coverage for in-vehicle environments. On the right is areas lacking coverage in an outdoor stationary environment.

It’s also interesting to consider how much area — in addition to how few locations — might be eligible for this program. Using the methodology with the most coverage, 376,504 H3 cells at the 9th resolution are eligible. That’s 14,500 square miles that could be eligible if it has a road or location, more area than Kentucky. Using the methodology with the least coverage (existing 5G coverage in moving vehicles), 4.1 million H3 cells are eligible. That’s 411,000 square miles, almost the size of Texas and California combined.

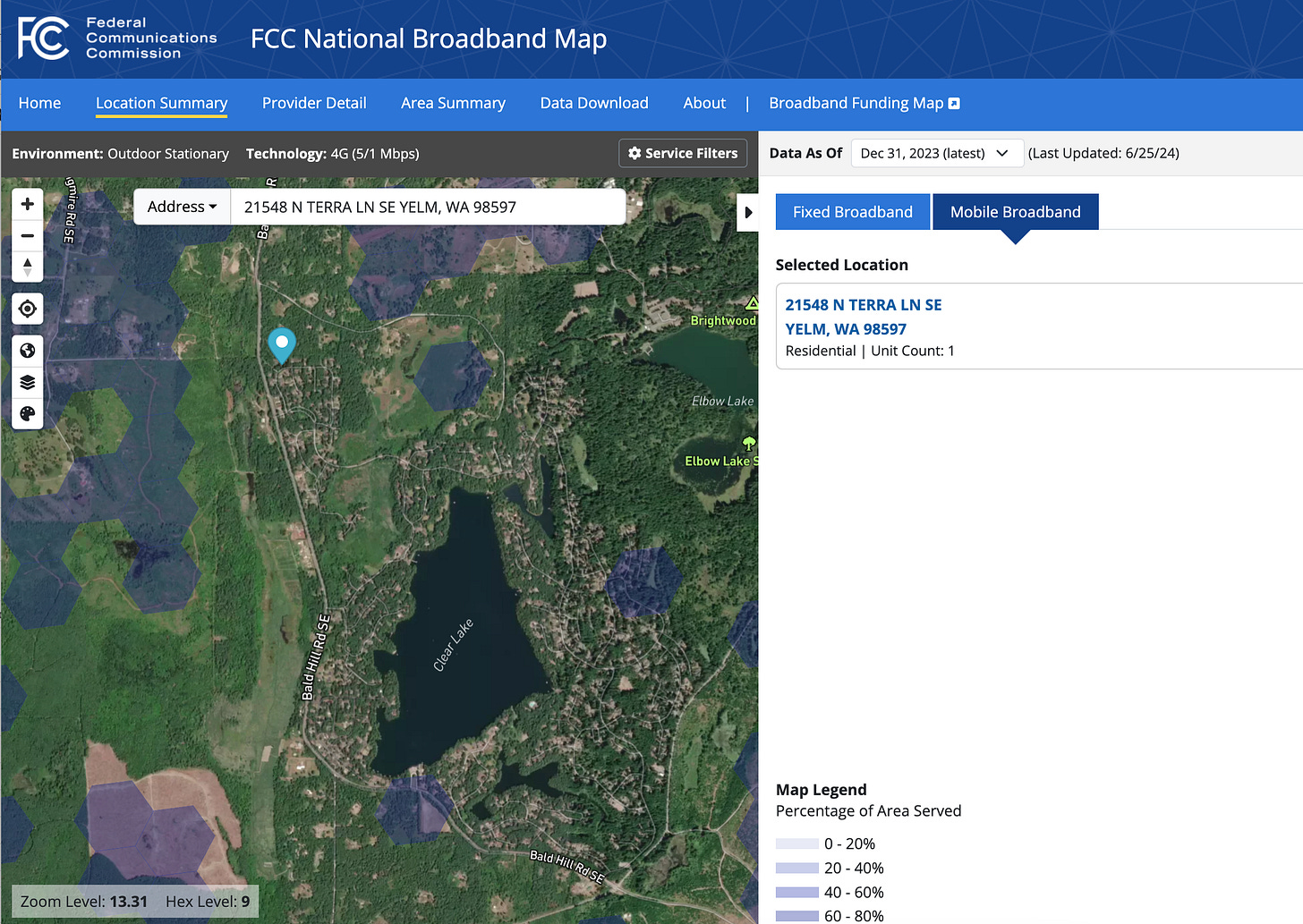

It would be great if these locations cluster together so one cell tower could cover thousands of locations. But we’re not that lucky. If you imagine a cell tower can cover a circle with a radius of 3 kilometers, there is one single location that would cover more than 1,000 other eligible locations. If you put a cell tower in this person’s backyard in Yelm, Washington, you could reach 1,374 other eligible locations. The 2nd best location reaches less than 1,000 unique eligible locations.

It degrades quickly, then slowly. The 10th best “cell tower” reaches 586 locations; the 20th best reaches 526 eligible locations. It goes on like that.

I always find it helpful to look at a sampling of random locations to get a sense for the real world of eligible locations. If the universe of eligible locations is those without access to 4G LTE in an outdoor stationary environment, we get the real hardest to reach places. Here’s a community in Newland, North Carolina, northeast of Asheville. While there is a local carrier offering 3G service, you can image a cell tower in this community would help significantly. (There is one provider offering fixed wireless service at 200/20, which absent a challenge would make it ineligible for fixed subsidies under BEAD).

Here’s a community in Renick, West Virginia that’s clearly on the edge of existing coverage. Both T-Mobile and Verizon have some coverage in this area, but it’s pockmarked. You can imagine both for the eligible locations — but also the ineligible ones — a cell tower within real reach would be helpful.

If eligible locations are those without 5G (but maybe with 4G) in an in-vehicle environment, interesting examples emerge. Here’s the first: a farm in Broadwater, Nebraska. This farm has 4G LTE from T-Mobile and Verizon, and 4G LTE from two smaller providers. It even has 5G-NR from T-Mobile, but not in an in-vehicle situation — only in an outdoor stationary model. (The farm has fixed FTTH service for what that’s worth — I think something). This farm would be eligible only if the eligible locations were those without 5G in an in-vehicle environment.

Before RDOF, the previous FCC published multiple rounds of the eligible census blocks. But no one, myself included, realized that they were proposing to fund airports, the Pentagon parking lot, and road medians, to name just a few of the examples. I don’t think this is the last we’ll hear of the 5G Fund, so here’s a first pass on data analysis for this important upcoming program.