If you’ve read my posts on the NTIA’s allocation of broadband funds, you’ll see I’m careful to say they are estimates. In particular, how the NTIA will allocate the 10% of the funding ($4.25 billion) set aside for high-cost locations has to be an estimate because the NTIA hasn’t shared guidance on how they plan to do that calculation. On a closer reading of the Infrastructure Investment and Jobs Act, I want to offer a possible — even likely — scenario where certain states get almost no funding in the high cost allocation because their Unserved locations are disperse and not concentrated. Iowa, Maine, New Hampshire, Ohio, South Dakota, North Dakota, Nebraska, and others — states with a high percentage of high-cost locations — may actually have a high-cost allocation of nearly $0.

The IIJA directs the NTIA to allocate the $4.25 high-cost funding by:

(i) dividing the number of unserved locations

in high-cost areas in the eligible entity by the

total number of unserved locations in high-cost

areas in the United States; and

(ii) multiplying the quotient obtained under

clause (i) by the amount made available under

subparagraph (A)It defines a “high-cost area” as :

(G) High-cost area.--

(i) <<NOTE: Determination. Consultations.>>

In general.--The term ``high-cost area'' means an

unserved area in which the cost of building out

broadband service is higher, as compared with the

average cost of building out broadband service in

unserved areas in the United States (as determined

by the Assistant Secretary, in consultation with

the Commission), incorporating factors that

include--

(I) the remote location of the area;

(II) the lack of population density

of the area;

(III) the unique topography of the

area;

(IV) a high rate of poverty in the

area; or

(V) any other factor identified by

the Assistant Secretary, in consultation

with the Commission, that contributes to the higher cost of deploying broadband service in the area.

(ii) Unserved area.--For purposes of clause

(i), the term ``unserved area'' means an area in

which not less than 80 percent of broadband-

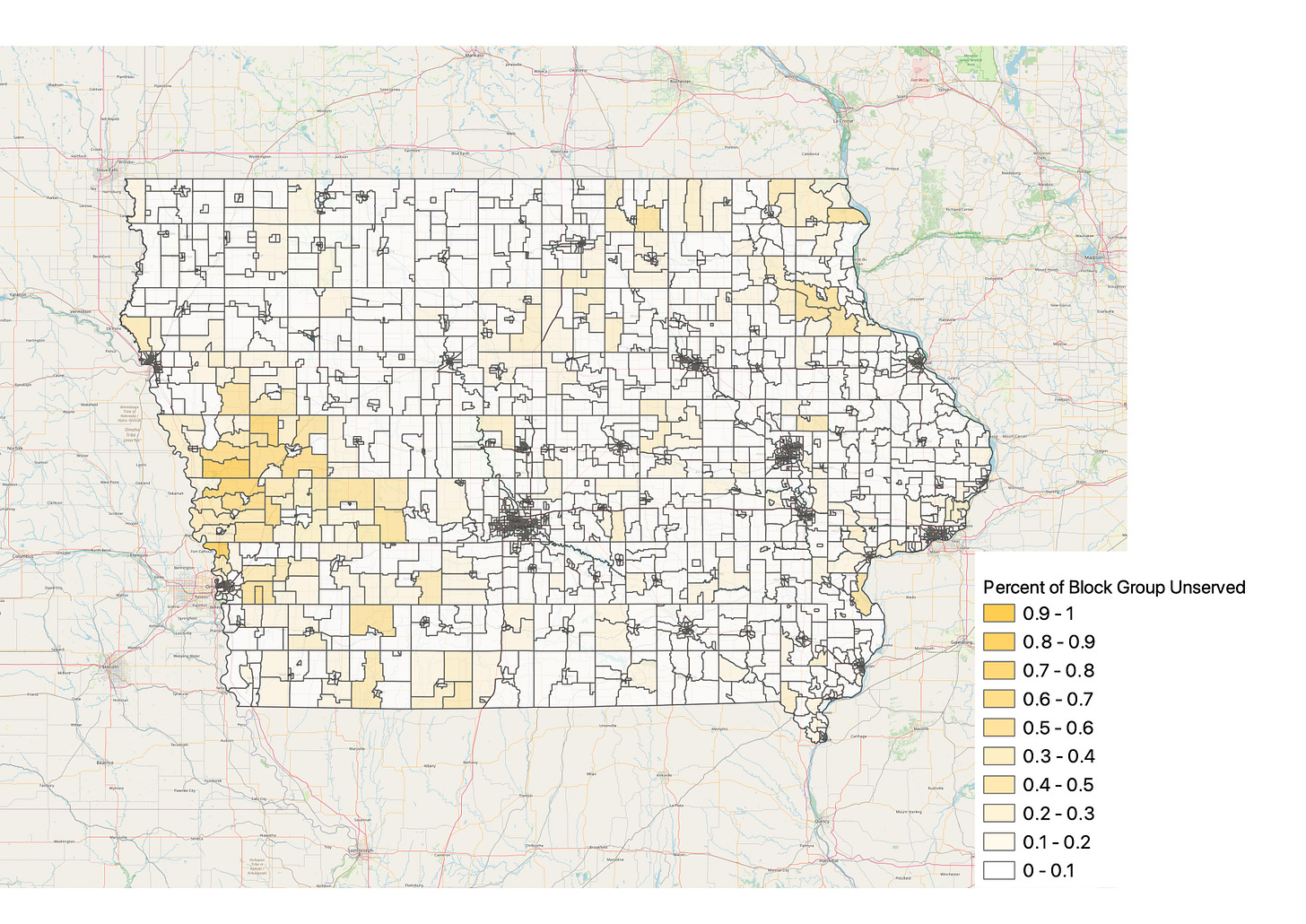

serviceable locations are unserved locations. The last sentence in the block above is particularly important. The law says that the $4.25 billion must go to areas that are more than 80% Unserved. If you remember my previous post about Gerrymandering coming to broadband, you’ll remember that the Unserved locations are way more dispersed than anyone thought when they were drafting this bill. Some states have essentially zero Unserved locations in areas that are 80% or more Unserved. In the map below of Iowa, there are Unserved locations spread throughout the state; almost none of them are concentrated together into block groups that are 80% or more Unserved.

To be clear, I don’t think NTIA has much discretion here. Anything that’s written into the law they have to follow. They have some discretion for anything that’s not defined in the law. So while they may have some discretion about defining areas or defining high-cost locations, their hands will largely be tied on this issue.

Let’s see how this might work. First we need to decide what high-cost means. Here I’ll use a definition of high-cost where the cost to pass is greater than $10,000 per location. By my estimates, 25% of the Unserved locations in the country are greater than $10,000 per location. Using this metric, each state’s allocation (represented in the chart below) is their number of high-cost locations divided by the national total of high-cost locations. This is the method I’ve used to estimate the high-cost allocation previously.

Things change if we read the statute strictly/correctly and also assume that the high-cost locations need to be in areas that are 80% or more Unserved. Whereas there are 2.15 million Unserved locations that are estimated to cost $10,000 or more per location, only 535,000 of them are in Census block groups that are 80% or more Unserved. (I’m using Census block group to represent the smallest “area” definition). The chart below shows the high-cost allocation if the calculation is done on high-cost locations in Unserved Areas. Some states are near $0.

What’s happening is that states have different concentrations of Unserved locations. In some states, like Louisiana, 55% of the Unserved locations are in 80%+ Unserved block groups. But in other states, like Iowa, they have almost zero locations in 80%+ locations.

I’m sufficiently certain that this estimate of the allocation is more accurate — again, the law is clear — that I’ve updated my allocations spreadsheet. Still, this is an estimate. I’m estimating the cost to serve a location, and I’m using Census block groups to define “areas”. NTIA will have slightly different data and definitions, but I believe these estimates are inching even closer to what NTIA will release at the end of June.

While the headline here is that high-cost locations may not factor into the allocation in a number of states, the “Unserved area” definition likely has additional implications. You could imagine trying to work around this rule by defining an Unserved Area as a single location— the country would be made up of 8.3 million Unserved Areas, 1-to-1 for each Unserved location. But such a trick, even if it were legal, would cause havoc when states need to use the same Unserved Area definition to waive the matching funds requirements, or decide what “areas” — in this hypothetical case, individual locations — are eligible for Enhanced ACP.

I assume the hard-and-fast yet arbitrary 80% Unserved rule was intended to direct funding to the areas most in need of broadband help. Hindsight is 20/20, and no one foresaw the mess that 25/3 and other Underserved filings would cause. Unfortunately, some high-cost states, already at a disadvantage because of much higher than average costs to build broadband, are likely not getting access to this slice of the funding.

The Notice of Funding Opportunity does allow for a single location to be considered an "Unserved Service Project", so maybe that is their way around the problem.

From page 17 in the NOFO: "(ee) Unserved Service Project—The term “Unserved Service Project” means a project in which not less than 80 percent of broadband-serviceable locations served by the project are unserved locations. An 'Unserved Service Project' may be as small as a single unserved broadband serviceable location."

The reason that last sentence is in the NOFO is because the NTIA knew there would be a lot of unserved locations that could not realistically be bundled in an area that contained 80% unserved locations. The same would certainly go for high-cost locations, and probably more so, since they are more likely to be scattered about, which is one of the reasons they are so expensive to build to and serve.

So, I would expect based on the language in the NOFO that high-cost locations that are off on their own would be treated like other unserved locations, where they can be defined as a single-location in an Unserved Service Project, and could also be deemed "high cost" based on the defined threshold in that state.

Looking at it from a different perspective, it seems that (I) - (III) -- and maybe (IV) carry more weight than how many unserved locations are isolated versus clustered in an unserved area. A typical case of an isolated unserved location might be a house set further back from the main road than the maximum drop length the service provider(s) will include in an installation without additional charge. The additional charge might not be huge, but the location would nonetheless be considered unserved, even though its neighbors -- located closer to the road -- would be served. Similarly, for fixed wireless, a location might be unserved because of Line-of-Sight issues that could be fixed by tree trimming or by raising the antenna.

I would not expect Iowa to have many extremely high-cost locations (although admittedly have not researched it well enough to say so conclusively). Utilities are mostly aerial and if below-ground construction is required, duct or cable can be plowed into the soft soil. Between topography and vegetation, line-of-sight for fixed wireless is rarely a problem. Construction can be done year-round.

You don't explain how you obtain the number of high-cost locations in each state. Texas, for example appears to be disproportionately high (considering its topography) while Vermont seems to be disproportionately low (for the same reasons). Cost modeling is treacherous, given the numerous factors and the fact that different providers will have very different costs.

My sense is that we won't have a reasonably accurate picture until the states have actual bids in hand -- presumably based on the bidders' preliminary designs, labor rates and materials prices.