A few days ago, the FCC released the 4th version of the National Broadband Map, with data as of December 2023. At a high level, the trend continues of fewer and fewer unserved and underserved locations: in the previous version, 10.1 million locations were unserved or unserved. Now, with six months more data, we’re down to 8.8 million locations needing better broadband service. That’s an 11% decrease over one six-month period.

Here’s the spreadsheet.

Here’s another way to think about it: when NTIA made the formal allocation, there were 11.9 million unserved locations. That was $3,341 per location. On the basis of less eligible locations alone, since the available funding stays the same, now there’s $4,645 per location — a 39% increase. And that’s not counting the 3.5 million+ locations that will be served by RDOF or Enhanced ACAM and not even eligible for this funding.

Some states made big changes. Nevada went from 53,508 underserved and unserved to 28,842 locations. That was a 47% decrease in the amount of unserved locations! North Dakota also lost 40% of its unserved, and there are many states that lost 15% or more of their unserved.

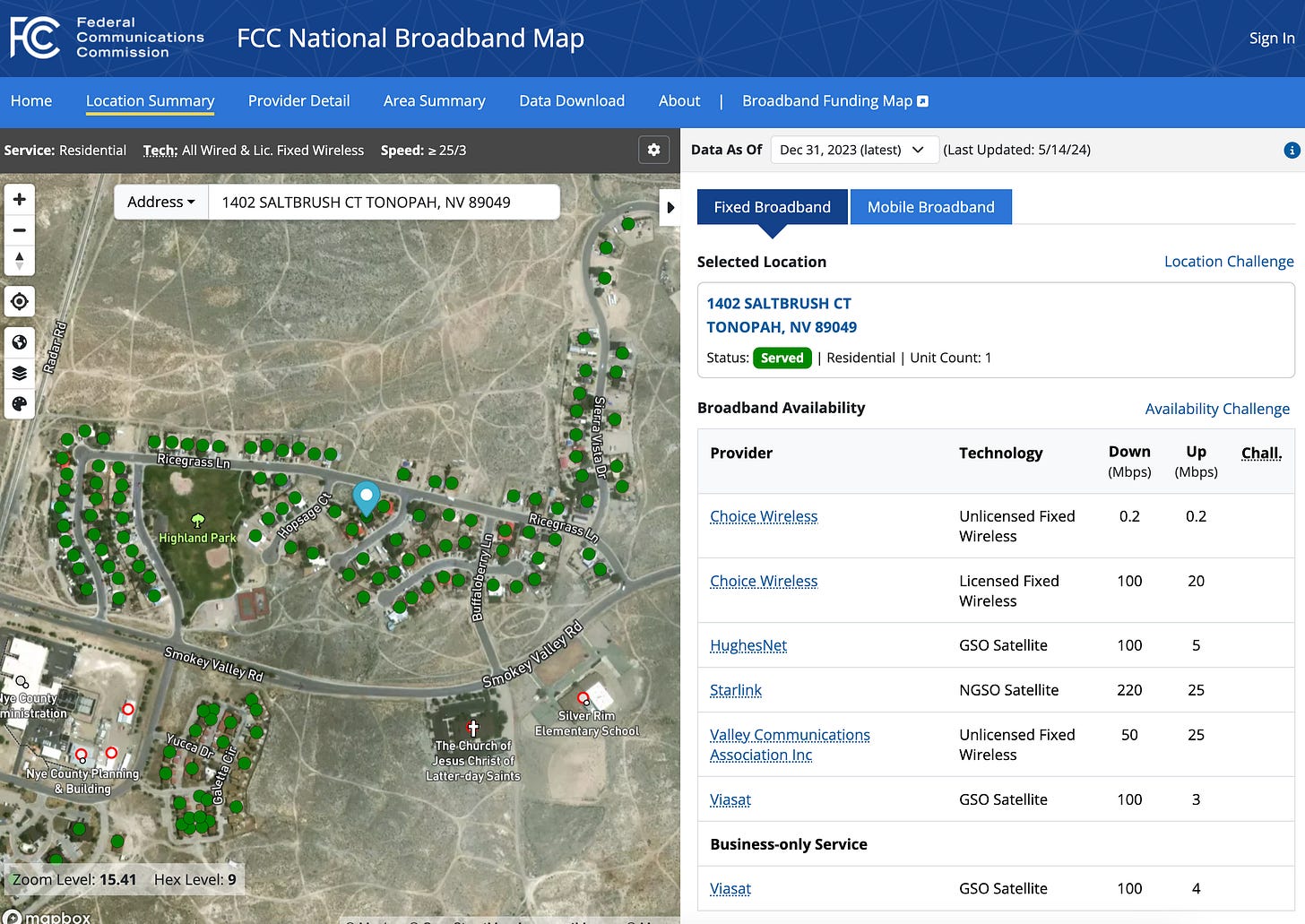

I always find it helpful to look at some random examples to understand what happened. In the first case, the previous version of the map showed this housing development in Tonopah, Nevada as unserved. In the latest version (2nd screenshot), Choice Wireless has increased their filing from .2/.2 Mbps to 100/20 Mbps.

The second random example is a maintenance station off Highway 50 in Carson City. Originally, there was only a fixed wireless provider who offered unlicensed fixed wireless. That filing, from Hot Spot Broadband has been changed to licensed by rule fixed wireless (likely CBRS) at 100/50 which makes it served. Charter also now covers the site with fiber to the premise, which it didn’t before.

The third location is in Las Vegas. In the previous version of the map it was underserved by Centurylink DSL. Now, it has Cox cable. And from the Cox website, they have a subscriber at the address.

I suspect there’s a lot going on behind the scenes with each of these updates. As the actual BEAD program implementations get closer, ISPs are acutely areas where grant money might start flowing. Also, normal buildout, including the RDOF program, is starting to show up on the map. I suspect there are hundreds of interesting stories embedded in each new version of the map. If you have ideas about what to look at, let me know in the comments.

we all know the 477 data is self reported, dated and prone to errors. The less reported fact is the way states have been handing out billions in grant funding (mostly unused covid stimulus), mostly to incumbents without any knowledge or oversight how it is applied. states have only just started reviewing this because the BEAD rules require elimination of any location that is subject to another federally funded grant. we have reviewed the data in our markets and found thousands of examples where carriers have received multiple grants to serve single locations and received grants to serve locations that are already served.