Cartesian and ACA Connects recently released the 4th version of their estimate for how far the BEAD money will go, finding that we can reach “at least 71 percent of eligible locations” with fiber. I like this study. It’s quite similar to the methodology I’ve used in the past. They estimate $61 billion is available (BEAD + provider matching) to reach the remaining 10.1 million unserved and underserved locations. They correctly reduce the 10.1 million locations because 3.2 million of them will be covered by FCC programs — mostly RDOF. But a footnote hints at a larger looming adjustment: the American Rescue Plan Act put billions into broadband, most directly with the $10 billion Capital Projects Fund. If ARPA-funded projects take ~1 million locations off the board for BEAD — we really don’t know what the number is because there weren’t up front reporting requirements — that could be ~15% of the remaining Digital Divide, before BEAD.

Why is this important? One requirement of the $42 billion dollar BEAD broadband deployment program is funding not be allocated where another federal program already provides an “enforceable commitment” to build broadband. In Section 60105 of the Infrastructure Bill, Congress instructed the FCC to keep track of the enforceable commitments. The result of that directive, the FCC’s Funding Map, now exists, and presumably will serve as a source of truth for where enforceable committments have been made, and by which program.

One problem: there’s only one CPF grant listed in the Funding Map for 20,000 locations in West Virginia. By my count, according to Treasury Department press releases, $7.4 billion has been committed through CPF covering 2.1 million locations. As we’ll see, that doesn’t mean 2.1 million currently underserved locations will get broadband. But some will.

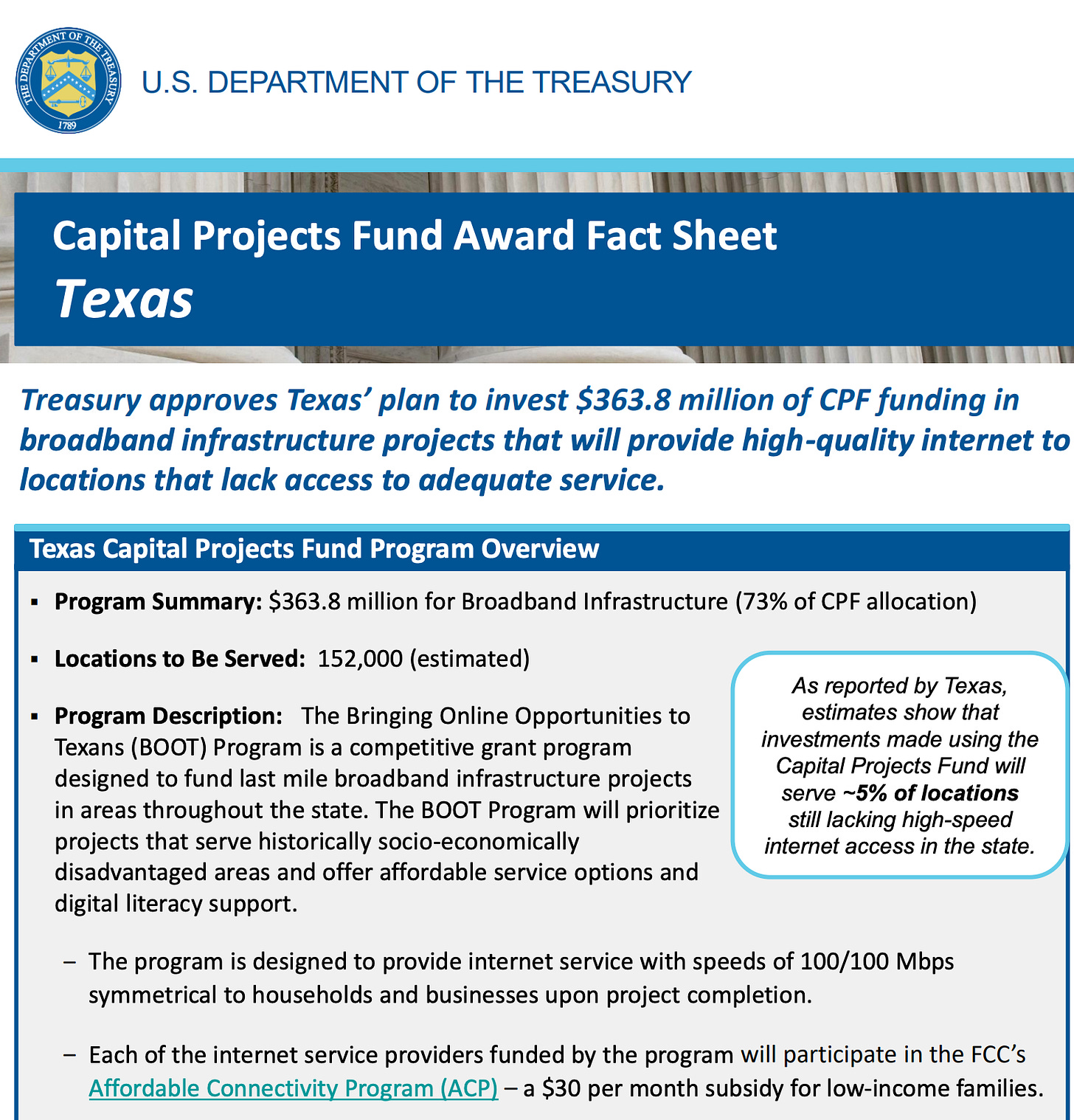

It’s important to note that the Capital Projects Fund didn’t require money be spent on underserved and unserved locations. It didn’t even require the money be spend on broadband deployment. If the press releases cover 2.1 million locations, it’s possible that only a fraction of those are still unserved or underserved today. For example, this award to Texas allocates $363.8 million to serve 152,000 locations. It doesn’t say that all those locations will be unserved or underserved. In fact, the side note indicating they will cover 5% of their underserved implies they will bring new service to about 57,000 locations (using the unserved+underserved number from the BDC data as of December 2022, which was 1.1 million locations).

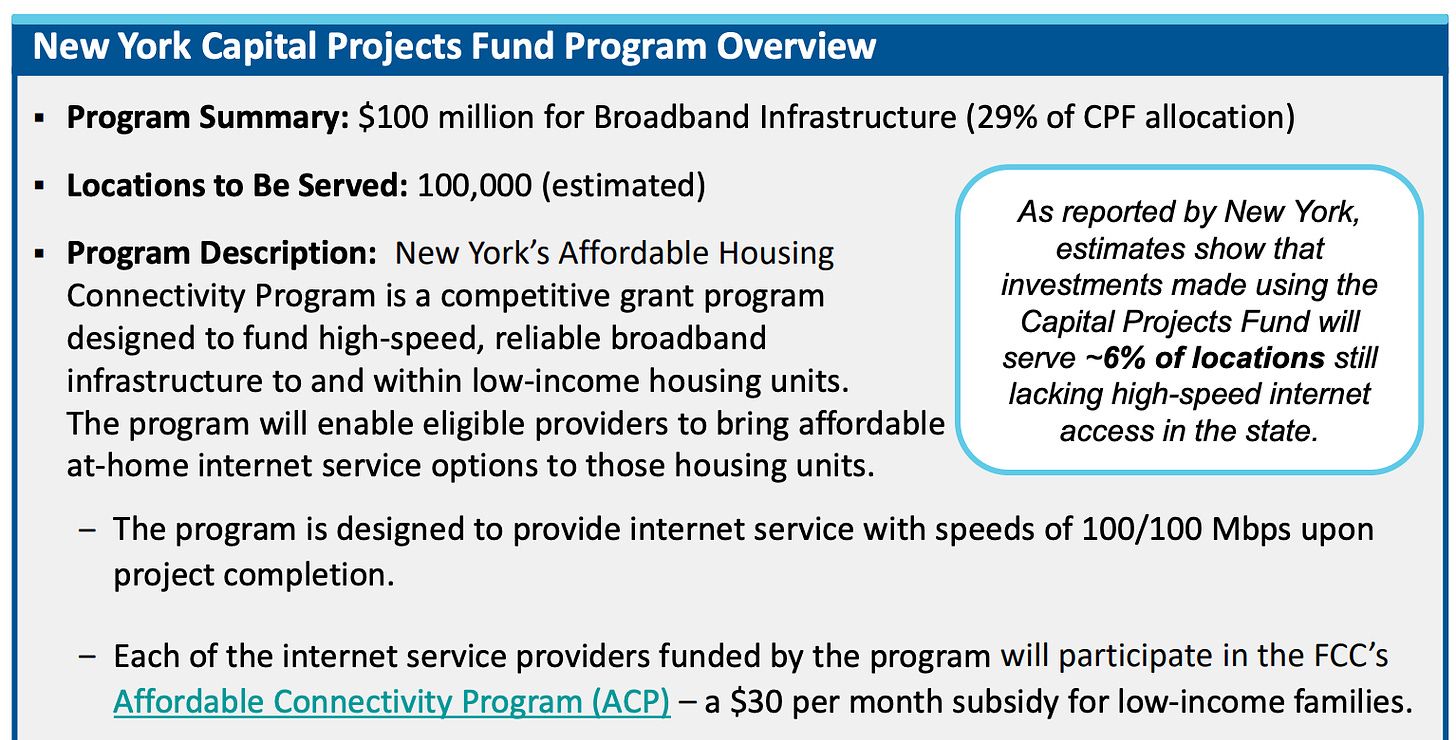

A different example is New York, where one of their CPF grants ($100 million for 100,000 locations) doesn’t appear focused on last-mile deployment for unserved and underserved locations at all. The state’s website confirms lots of different types of projects would be considered for this funding.

I’m not suggesting anything untoward is happening with any of these grants. In fact, they were designed to let states spend the money however they thought best and there were no rules mandating money be used on new last-mile infrastructure to unserved locations.

But it does make things hard when we want to know which still-unserved locations have an enforceable commitment from a CPF grant. Let’s take a tour:

In Minnesota, the 1st 2023 grant listed was to Tekstar. It’s a grant of $880,000 (50% of the project cost) to bring service to 256 locations in rural Wright county. There’s a PDF map with a pin on it for every project. I don’t see a way to download a shapefile of the project, let alone location IDs.

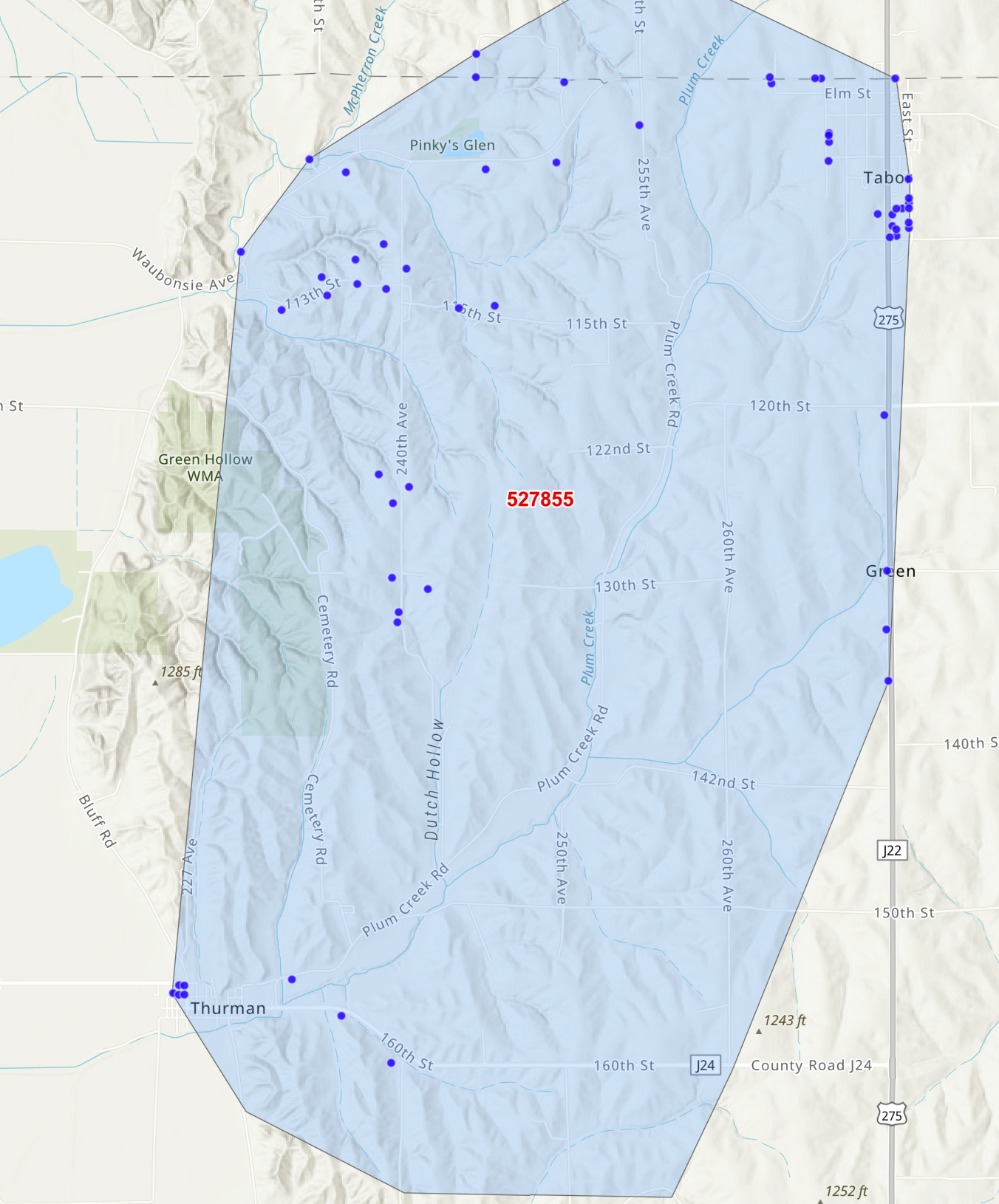

In Iowa, Nextlink won $893,000 (70% of the project cost) for a FTTP project to cover 80% of the locations in Broadband Intervention Zone 60. That’s 62 locations. There’s an interactive map, which shows, strangely, that Windstream has fiber to most of the town on Thurman, IA, but Nextlink is getting grant money for the little section without Windstream fiber. The scattered unserved locations in the southeast of Thurman will remain unserved and presumably be eligible locations in BEAD. There’s no data download.

In Virginia, one of the many VATI (ARPA-funded) projects is $3 million to Verizon to bring Fios to 1,347 locations in Greensville County. Interestingly, Greensville surrounds, but doesn’t include, the city of Emporia, VA. Emporia is almost entirely served by Comcast cable. In addition to the 1,347 locations that are going to get their first wired broadband offering, I suspect the city of Emporia will get a 2nd wired offering.

In this case, Virginia provides point shapefiles of the locations covered by each 2023 VATI award though there’s no Fabric Location ID. (For 2022 and 2021 awards there are polygon shapefiles). Virginia also published a list of what they consider unserved and underserved which allows you to infer what locations are covered by VATI awards.

In Texas, a sign of the data struggles is clear: near the top of the page is the reminder that they’ve ask all applicants to submit location IDs for their project areas. It doesn’t appear any awards have been publicly released.

One other point: the lack of clarity around which locations were funding makes any analysis of these awards difficult. In most states you can find some listing of the amount awarded and locations claimed to serve. That allows a top line award $ per location passed, but without knowing the individual locations, it’s not certain that the definition of “unserved” matches the BEAD definition, or that the locations remain unserved now.

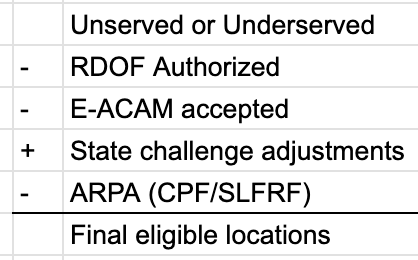

The list of locations that will be eligible for BEAD funding looks something like this:

The impact of all of these are well understood — with the exception of the ARPA projects. For the ARPA projects, the lack of upfront reporting requirements has led to an impression that states are trying to figure out which locations they funded. The $42.5 billion is fixed. So every location that comes off the board increases how far the funding goes. It’s almost certainly greater than zero and less than 2 million locations, but it’s hard to say beyond that. And it will make a big difference to the final list of BEAD-eligible locations.

Yes, I believe this is significantly undercounting the number of locations that will be served or that have committed funds when BEAD money starts flowing. I've been assuming that all or most of the locations that are being built out with ARPA funding are unserved or underserved or otherwise the projects would not have been approved. For example, this Treasury Department summary of a $540 million dollar California award (100% of their CPF allocation) says that the CA grant program is "designed to provide internet access to areas of the state lacking access to reliable broadband speeds of 25/3 Mbps", and the award will provide reliable broadband to around 127,000 locations [https://home.treasury.gov/system/files/136/CA-Fact-Sheet-April-2023.pdf]. It also says that's "16% of locations still lacking high-speed internet access in the state." That's huge.

I do expect that prior to BEAD funding projects being approved the NTIA will have all of the information about these commitments, so we should not see any overbuilding in ARPA-funded locations. And, ARPA funding, like BEAD funding, is awarded by the states to the broadband operators, so the states will certainly know where the money is going.

Whether these locations ever show up on the FCC map as committed prior to actual deployment is another question. It may not be until the broadband operator does their biannual BDC filing to report the locations served, and that will be at least a six month lag, and up to ten months, from the time the locations are served until when they show up on the map. For example, if a project was completed earlier this month, those locations would not show up as served on the FCC map until November.