A random sample of the Digital Divide

Apropos of nothing, I thought it’d be interesting to take a tour of the remaining United States Digital Divide. These locations are a random sample of BEAD-eligible Unserved and Underserved locations that are not part of RDOF or ACAM. Here is the spreadsheet of 1,000 such random locations. I’ll look at the first eight below.

We have this mental model of the remaining Digital Divide as a rural farm, a home at the top of a mountain, or a few dozen people in a remote Alaska village. The reality is more complex. The remaining Digital Divide is a combination of data issues in the map, dense locations that for whatever reason haven’t yet been served, locations on the “network edge”, and maybe yes, some locations that are just plain remote.

I can say this for certain: a state that designs their grant program with the mentality that everything is rural and remote is going to burn through cash and come up short. By contrast, a state that recognizes that there are many reasons a location is Unserved or Underserved, and that many of those reasons don’t need large subsidies to incentivize deployment, may have a chance to reach all their Unserved and Underserved.

First up, a home in Quincy, California. This home has an unlicensed fixed wireless provider claiming 500/200 service, and curiously, a fiber to the home provider who is only claiming 50/10 service. (Offering FTTH at that low throughput level puts this ISP in a tiny sliver of fiber providers that don’t “Serve” their customers, and suggests a data error.)

This home is part of a small neighborhood, but importantly, the core of Quincy, just down the road, is considered Served by a licensed fixed wireless provider claiming 200/20 service. This town would be an attractive target for a fiber ISP, which could take huge market share from the WISP in the town, and get subsidies for reaching still-reasonably-dense locations on the outskirts.

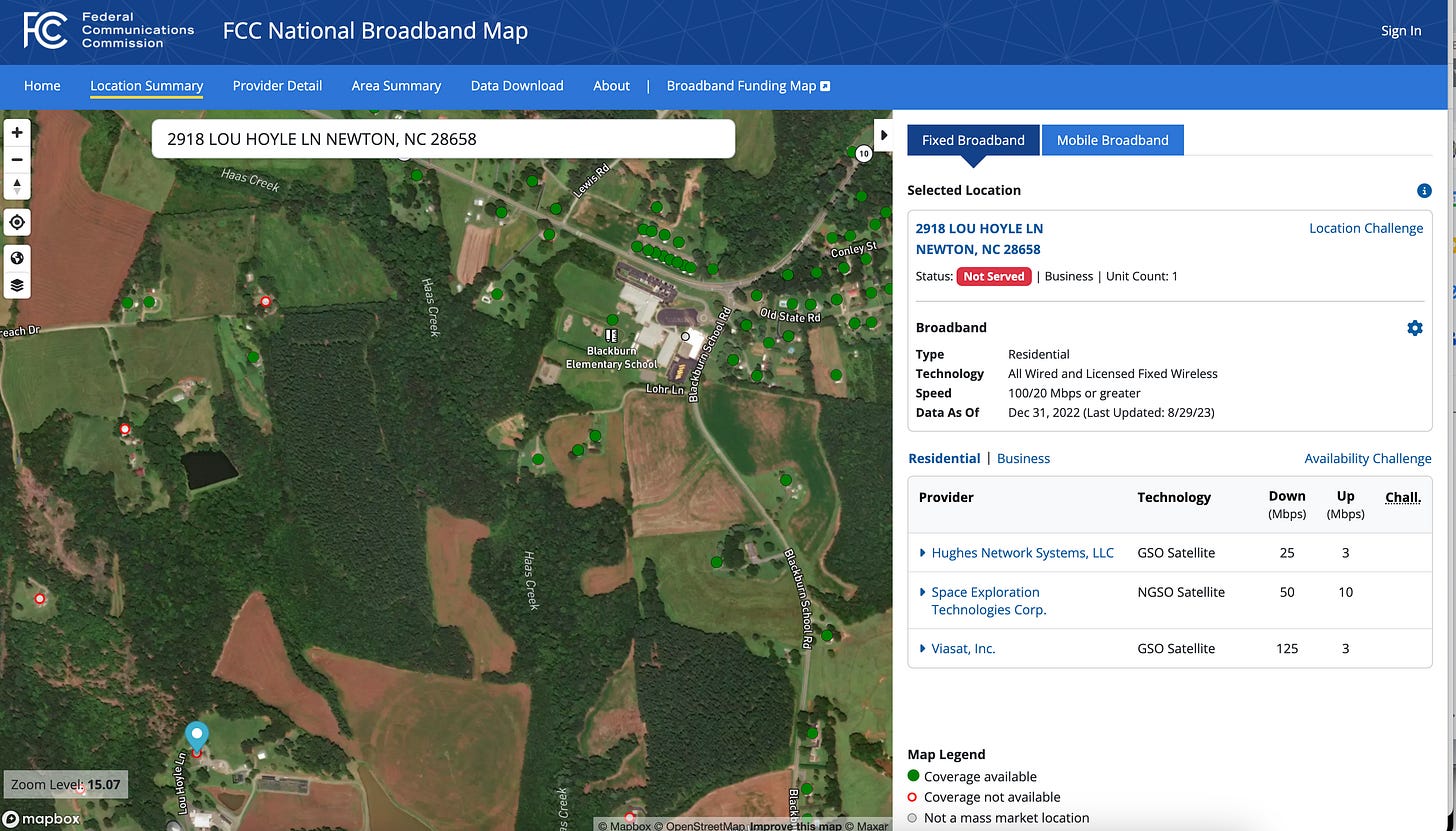

Next up is an Unserved farm in Newton, North Carolina. This farm should also be in decent shape: Charter has cable surrounding this farm on three sides. AT&T has DSL in the area.

Likely this farm is part of what we used to call a “partially served” census block. There is service in part of the Census block, and under the old maps that’s all we knew. Now with the FCC’s new maps we can see at the location level that there’s a farm here that doesn’t have service when some of its neighbors do. What it also means is someone — in this case a couple someones — have wired infrastructure nearby. And should be able to serve this location at reasonable cost.

Next is a home in Troy, Alabama, south of Brundidge. Troy Cablevision offers symmetrical gigbit fiber service to about 2/3rds of the homes along this road, including a couple that are far off the main road, near the home we have selected here. It is likely this is a filing error (there are hundreds of thousands like this), and Troy Cablevision serves this home. It is nearly certain they serve other homes on the road.

This is another one that hopefully costs the state of Alabama $0 to serve, along with all of its neighbors. Though my cost model, which doesn’t understand this situation, thinks it should cost $9,282 to serve this location.

Next up, a home just outside Loveland, Colorado, in Berthoud. This looks to be legitimately the “network edge”, where the ISPs that serve Loveland stop, and then WISPs, which reach a little further, also don’t reach many locations. Still, it is 2 miles from a residential neighborhood served by a fiber provider. This is not the top of a mountain.

Next, a likely data issue in Wylie, Texas, where cable covers everything — including nine locations in the corn field — except these eight locations. Texas should try to pay $0 for these locations.

Next is a home in Anthony, Florida. Verizon serves most of the town at 100/20 with their fixed wireless product. But at some point, the filing drops to a claim below 100/20, at which point this home becomes Underserved. I think a wired ISP would get 80% market share in this town. While no wired ISP has deployed here, which suggest a problem with the return on the investment, it should not need a substantial subsidy at this density and without competitors.

Next, a farm just off a main road in Renick, West Virginia. Here again, a cable ISP serves a seemingly random 50% of the homes and businesses along the main street, suggesting a data problem. We can’t tell whether the ISP’s wires extend to this farm. Either way, this is not and should not be an expensive location to serve. I hope West Virigina pays $0.

Interesting. I agree that a lot of locations that are still listed as unserved will not be expensive to deploy or may already be served. If states are just counting locations at this point, they may be pleasantly surprised at how far their funds will go. Hopefully a lot of situations like this will be addressed in the BEAD challenge process by the local communities and ISPs that serve there. In fact, I would bet that some of these will be resolved on the next FCC map. The BDC filing window just closed, and the next map should be out in about two months.

In looking at the map, I agree that Altice made a mistake in their previous BDC filing and only reported customers instead of locations they can provide service. I don't know about the farm, but I would say all or most of those locations in that area that are red are actually passed by Altice and already served.

In Anthony, FL, it looks like they've got Lumen there with DSL. In some places it's listed over 25x3, and in others 10 x 1 or less than a meg. That would depend on how far the subscriber is from the DSLAM. Lumen should be able to easily qualify for BEAD funding there, and with an existing subscriber base and infrastructure, it should not be a high cost per location relatively speaking. I wouldn't be surprised if the possibility of getting BEAD funding has stopped private investment in some areas like this. If an existing service providers doesn't have a wired competitor moving in, they may be waiting to see if they can get a BEAD grant to help upgrade their infrastructure to fiber.

In Wylie, TX, I see one area where it looks like either some reporting errors, long-driveway problems or maybe both. In looking at the satellite, I think it might be mostly the latter, where Charter is serving nearby homes, while some homes further off the road do not have service. They may have a high install fee for those locations that some paid, and others won't. It would be good if states addressed that with providers. Maybe they could say something like: "If you want BEAD funding to service these other areas in our state, you need to commit to connect all of these one-off locations that are already within your service area that do not have service, and for no more than your standard installation fee." I also see a dense neighborhood near there that is about 25% covered by Charter, and those are all clustered together on the north and east side of the neighborhood, so it's possible that they are in the midst of deploying cable modem service there. That neighborhood also seems to be on the cusp of where Frontier and Charter meet. Frontier serves the locations on the west side of the main road with fiber, and Charter services locations on the north and east side of that neighborhood.

In Troy, AL, it does look like Troy Cable should be able to serve the locations that are listed as not served. That could also be a BDC reporting error that will be resolved in the next map.

You are right about all of these. However, you're hoping that states will take the time to resolve what you have described as hundreds of thousands of similar issues. I think states are going to be under so much pressure to get the BEAD money out the door in 2024 that they are not going to have to time to get this granular.

You are also not mentioning the reverse of this situation. I still think there are a big number of locations that are shown as served on the FCC broadband map, but which aren't. I'm curious about how many state broadband offices are going to accept factual challenges to such locations to be brought into the grant program?

Doug Dawson