With the allocation of broadband funding behind us, we can turn [again] to how far the funding might go in connecting the unconnected. Instead of making predictions about how far the funding can go, I’d like to alter the frame slightly: how can we make the funding go as far as possible? The answer is that state grant plans need to be laser focused on how to generate competition and keep costs as low as possible. If we can do that, we stretch the BEAD dollars as far as possible. If we don’t, we run out of money.

It’s really quite easy to construct this framework. We only need two pieces of data: the number of unserved and underserved locations, and what we pay to reach them. According to the latest FCC maps, there are 8.5 million Unserved locations and 3.6 million Underserved locations — a total of 12.1 million locations.

The BEAD program doesn’t need to fund all of these locations. The FCC’s RDOF program already has commitments to fund new broadband buildout in 2.35 million locations that are currently Unserved or Underserved. Large grants are available through the Department of Treasury that will also build out new broadband. The Treasury ARPA grants could fund as many as 2.7 million locations, though it’s not clear whether they are all Unserved locations, so I won’t subtract them from BEAD’s obligation.

At this point I’d like to introduce a hypothetical example. Let’s assume there’s one state, the State of America, and its federal government allocated it $42.45 to close its 12.1 million location Digital Divide.

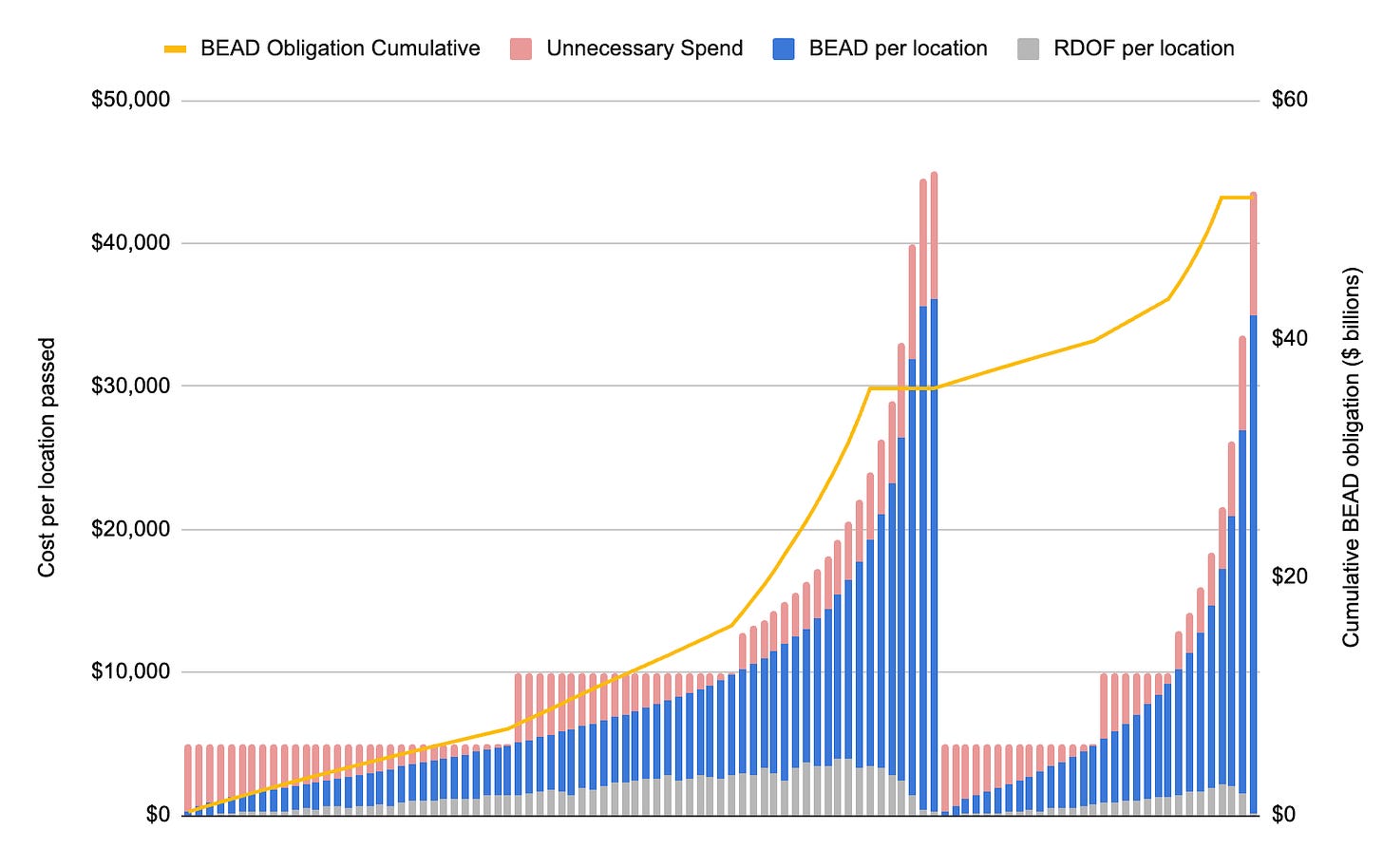

Each of the bars across the X-axis represent 1% of the total Unserved and Underserved locations. That is, each bar represents 121,000 locations in my state. The grey portion of the bar is the locations that RDOF will be funding, and aren’t the responsibility of the BEAD program. BEAD only needs to fund the blue part of the bar.

Let’s make one further refinement to the locations. Every state is allowed to set an Extremely High Cost Location threshold, and use satellite or other technologies to reach those locations. In my example, I might set the EHCL threshold at $20,000 per location passed. That essentially excludes 9% of the locations.

Now we’ll turn to estimating the cost to pass a location. I reverse engineered the FCC’s RDOF reserve prices and turned it into a a national cost model (*methodological notes below). To capture inflation and supply chain issues, I add 35% to the reserve prices. This model estimates a cost of $93.5 billion to reach all the locations, an average of $7,904 per location.

I hope NTIA or states will be able to publish their own cost models. Until then, I’m open-sourcing this illustrative cost model. Here’s the data file. (I don’t have a cost-effective way to do online mapping for the whole country or I would show it on an interactive map).

The bars in the chart above are ordered from left to right in increasing order of their cost to pass the location. First is the Unserved, from locations that only cost a couple hundred dollars per location passed, to the most expensive locations that are above $36,000 per location. Then the same thing with the Underserved.

So we’ve established that BEAD needs to fund the blue section of the bar (the Unserved or Underserved locations less what RDOF is funding). And we’ve established that we aren’t going to fund locations above $20,000 per location. There’s one more adjustment to make: private capital is expected to fund part of these projects.

In this example, I assume that private capital would bring 75% of the funds for locations that cost less than $5,000 per passing, on the assumption that some of these locations are edge-outs of existing networks, spots within the footprint of existing networks, or reasonably dense towns currently [Un]served by DSL that would make attractive project areas. Between $5,000 and $10,000 per passing I assume private capital brings 50% of the funding; and $10,000 to our $20,000 EHCL threshold I assume private capital brings 25% of the funding.

The yellow line (corresponding to the right axis) is the cumulative cost to the BEAD program in this hypothetical example. On the left hand side of the chart the Unserved locations are inexpensive, and private capital brings 75% of the funding, so the yellow line doesn’t go up very quickly. In the middle, the locations are getting more expensive, and the private capital match goes down, so the line starts to increase faster. (RDOF helps by taking 20-30% of some of these areas.) The line starts rising quickly until we hit our EHCL threshold where our costs become minimal again. Once we’ve reached all the Unserved, the line keep growing in the same way as we fund the Underserved.

In our hypothetical State of America that was allocated $42.45 billion, we only need $29 billion to reach these locations, if the program is executed in an highly efficient way. This result is not surprising. I’ve been using this same framework for many months now and the results are always in this same ballpark. It’s noteworthy that the consulting firm Cartesian, on behalf of ACA Connects, is using a similar methodology and getting similar results.

I’m making the critical (and difficult-to-achieve) assumption that I’m able to fund every location at exactly the cost from the cost model. I worry though that actually achieving this is far easier said than done. It definitely is not going to be self-executing. Why? Two reasons:

The universal coverage goal of BEAD is a difference in kind, not just degree. It is very different to design a grant program that, ex ante, can be said to "ensure" 100% coverage of unserved locations than it is to just award a pool of funds to take a bite out of a much larger unserved location problem, with no expectation that all locations will be reached.

As I've covered several times now, the actual distribution of unserved locations is highly intermingled with served locations. Only 27% of unserved locations are in CBGs that are themselves 80% unserved. So it definitely won't work to just award projects to "unserved areas," based on requiring a high percentage of unserved locations.

These two factors raise some big questions for states. For example, depending on how project areas are defined, it may be difficult to attract multiple applications that create pressure to request only truly needed BEAD funds (for example, a "competitive award" requirement is meaningless if project area rules mean only one provider can submit a viable application in an area). Or if applications overlap, will states figure out ways to resolve conflicts without throwing out the baby with the bathwater (which is to say, all of the non-overlapping portions of the applications that come in second, third, or whatever to the best application in the area of overlap)? And what happens if a material number of unserved locations don't receive ANY applications?

Time pressure is also going to start to be a big concern. States now have less than 180 days to finalize their detailed BEAD grant plans. In fact, due to the public comment requirement before a plan can be submitted to NTIA, that's probably more like 3 or 4 months. Then they have 1 year to contingently award ALL of the BEAD funds to specific projects for the Final Proposal. As Doug Dawson has pointed out, that's a far faster timeline than what states are used to. Given this 1 year timeline, for example, it doesn't seem possible for a state to address the universal coverage requirement via multiple, sequential rounds of awards unless NTIA decides to waive those deadlines and allow state award processes to continue into 2025.

And if state grant rules don't figure out solutions to these questions, it's very easy to see how my projection that there is plenty of BEAD money to achieve universal coverage could turn out to be dead wrong in practice.

Let’s look at an one tiny example related to this. Below is Waterboro, Maine, where Charter serves most of the town with cable. But there are about a dozen locations throughout the town where, for whatever reason, Charter didn’t file coverage. My coarse RDOF-based cost model thinks this block group costs $12,380 per location. Maine will want need to fund these locations— and many others like them— at $0.

Now let’s take a tour of how this can start to go wrong. One possible scenario is I could fund all the inexpensive locations at $5,000 per location. That seems reasonable at first glance. After all, the average is $7,904. And maybe I fund all the medium-expensive locations at $10,000 per location. For the high-cost locations, I feel lucky that anyone wants to serve them so I wind up giving 25% more than my cost model implies. For anything below $10,000 per location I want a private capital match of 50% (ISPs contribute half, that’s pretty good! I tell myself). Above $10,000 per location I’ll get the private capital match waived.

What happens in this scenario is we wind up overpaying by the amount represented in red on the bar in the chart below. Costs accumulate much faster. Instead of funding all the Unserved and Underserved locations with $29 billion, we need $52 billion, 79% more money, and well above our budget.

The solution is we need to keep the cost per location as close as possible to the underlying curve. And the way to do that is to use grant rules to encourage competition and limit 1-bid locations, particularly in low-cost areas.

Things look different at the state level. Each state only has a portion of the $42.45 billion, and importantly, each state’s cost curve is unique. Nebraska was allocated $405 million, and has 108,601 Unserved and Underserved locations. That’s $3,729 per location. But their estimated average cost to pass a location is $19,567.

The same money-saving factors apply. About 10% of the locations will be covered by RDOF. If you set the EHCL threshold at $28,000, you exclude about 20% of the locations. Still, no matter how you do it, Nebraska accumulates costs much faster than other states. To reach all the Unserved and Underserved with fiber they’d need an estimated $840 million, more than double their allocation.

Despite this likely outcome, which is frankly just unfair to Nebraska and other high-cost states, it doesn’t negate the point: Nebraska can’t overpay, or it will run out of money even faster. Like every state, the grant plan needs to be laser focused on how to generate lots of bids and keep costs down.

With the clock running on designing these grant programs, I’m worried that the thicket of legal and practical issues will distract from the also-important goal of making the grants follow the cost curve to the maximum extent possible.

*Methodological details on reserve price cost model: I use the “reserve prices” from the FCC’s RDOF auction. The reserve price is the price above which the FCC was unwilling to fund a location. While I don’t think they intended it to be used this way, it very strongly resembles the FCC’s A-CAM cost model. As stated, I add 35% to the reserve price to capture inflation and other supply chain issues. Some states have relatively few RDOF-authorized blocks currently, but there could have been many more RDOF-eligible blocks before the auction, and each will have a corresponding cost per location. The RDOF bidding areas were 2010 Census block groups so that is the most granular geography. To convert the 2010 Census block groups into 2020 Census block groups (the geography of the BDC data), for every 2020 Census Block Group I find the closest RDOF-eligible 2010 Census Block Group and apply the reserve price from the 2010 block group to the 2020 block group. This works quite well for states that had lots of eligible blocks. It works less well if the state didn’t have many eligible blocks, such as SD, ND, and MT.

What are you basing your assumptions on regarding the amount that private capital is willing to fund? Cartesian's analysis assumes $70 ARPU, 70% take rate, average margins of 90%(!), and 15% ACP participation to decide that ISPs will be willing to contribute $3K/passing. This is wildly optimistic and a key component of any analysis. I'd like to see you elaborate on how you arrived at your numbers.

The most important job for any home of commercial building project is to ensure the building is correctly laid out. This use to require a plumb bob and range finder equipment. Now its done with GPS but none the less if the building is not laid out correctly its down hill from there! There is NO standardized or third party validated data in the entire Trillion Dollar Broadband Marketplace so your data building exercise is compromised as its garbage in and garbage out! The building runs into structural problems immediately as it has now been incorrectly laid out due to faulty data. Standards are required throughout the building process while none exist in the world of broadband! And we all know who benefits from this don't we! Come on man, self auditing? When in 10k years of recorded history did that prove to be successful. I got a bottle of Snake Oil that will handle any ailment you got.